Business Insurance in and around Plano

Calling all small business owners of Plano!

Helping insure businesses can be the neighborly thing to do

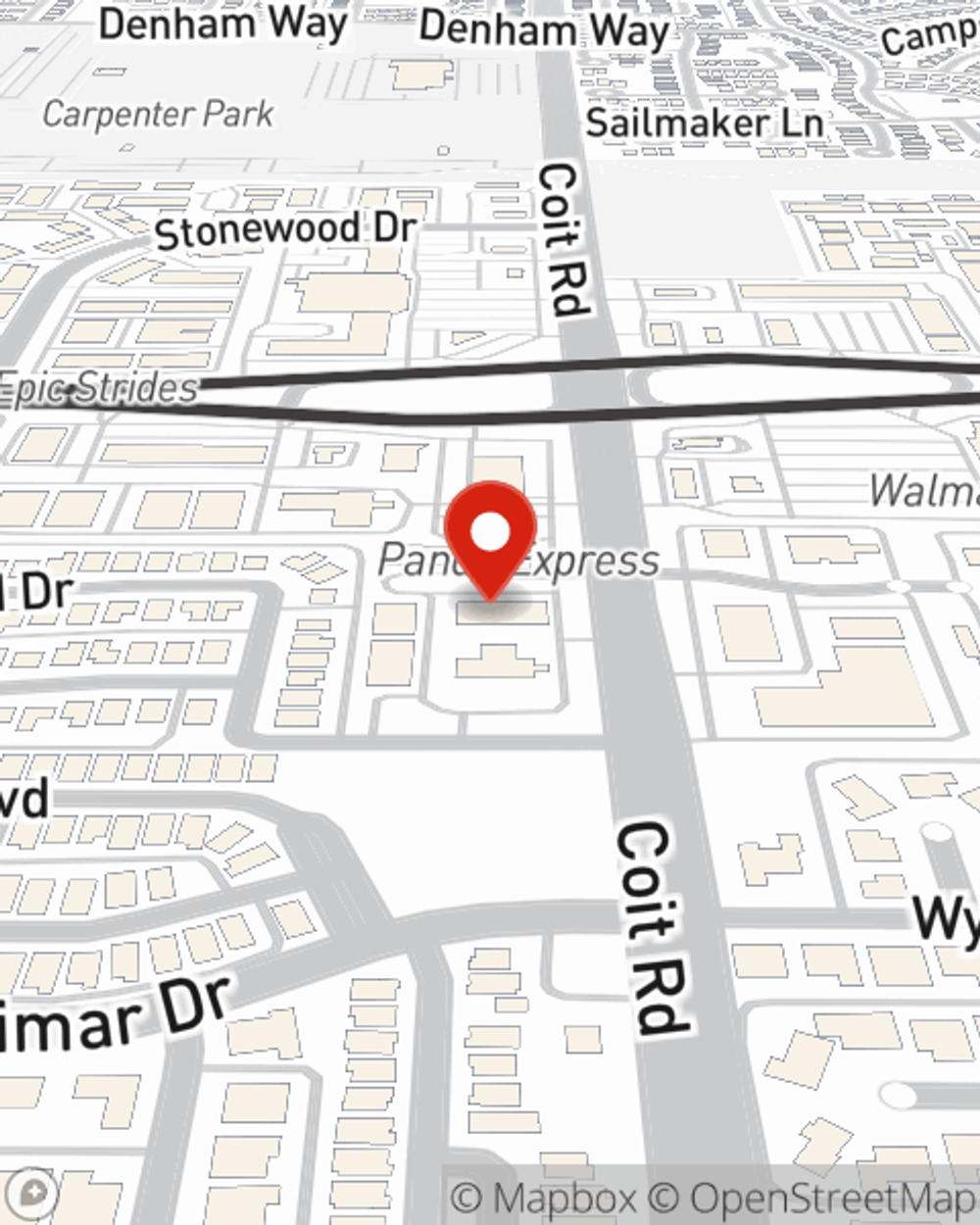

- Plano, Texas

- City Line

- DFW

- Prosper, Texas

- Richardson, TX

- McKinney

- Frisco

- Houston, TX

- New Hope, Texas

- Princeton, Texas

- Missouri City

- Sugar Land

- Carrolton, Texas

- Princeton, TX

- Dallas

- Addison

- South Lake

- Las Colinas

- Trinity Grove

- Sachse, Texas

- Garland, Texas

- The Woodlands

- Anna, Texas

- Celina, Texas

State Farm Understands Small Businesses.

Being a business owner is about more than being your own boss. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, business continuity plans and extra liability coverage.

Calling all small business owners of Plano!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Chelsea Terry for a policy that covers your business. Your coverage can include everything from worker's compensation for your employees or business continuity plans to professional liability insurance or commercial auto insurance.

Ready to review the business insurance options that may be right for you? Call or email agent Chelsea Terry's office to get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Chelsea Terry

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.